Vavada Casino — это онлайн-платформа для азартных игр, которая предлагает игрокам широкий выбор игр казино и турниров. Одной из ее примечательных особенностей является личный кабинет, который предоставляет пользователям ряд преимуществ.

Vavada casino

100% бонус в казино Кэшбэк 10% 100 Фриспинов в подарокVavada официальный сайт

Vavada casino

100% бонус в казино Кэшбэк 10% 100 Фриспинов в подарокVavada официальный сайт Vavada casino

Приветственный бонус за регистрацию Актуальное зеркало Вход на сайт сейчасВход на зеркало Vavada

Vavada casino

Приветственный бонус за регистрацию Актуальное зеркало Вход на сайт сейчасВход на зеркало Vavada Vavada casino

Бонус до 1000$ 100 бесплатных вращений Бонус в Андройд приложенииЗабрать Бонус Вавада

Vavada casino

Бонус до 1000$ 100 бесплатных вращений Бонус в Андройд приложенииЗабрать Бонус Вавада

Функция личного кабинета позволяет игрокам иметь персонализированный и централизованный интерфейс для своей игровой деятельности слот. Они могут получить доступ к различным функциям и услугам из одного места даже при блокировке сайта, экономя время и силы на навигацию по сайту.

Игроки могут создать свой личный аккаунт, пройдя простую процедуру регистрации в казино Вавада по промокоду. Им необходимо указать основные данные, такие как имя, электронная почта и номер телефона. Для обеспечения безопасности учетной записи также требуется верификация провайдер.

Личный кабинет Вавада позволяет игрокам новичкам удобно управлять своими средствами live. Они могут легко вносить деньги на свой счет, используя различные способы оплаты, такие как кредитные карты, электронные кошельки или банковские переводы. Вывод средств также осуществляется без проблем, что позволяет пользователям получить доступ к своим выигрышам в слотах или турнирах без лишних хлопот.

Благодаря функции история игры в слоты пользователи могут отслеживать историю и статистику своих игр. Новичок может просматривать свои прошлые ставки, выигрыши, проигрыши и общие результаты. Эта информация поможет игрокам анализировать свой игровой процесс, принимать взвешенные решения и совершенствовать свои стратегии.

Vavada casino

100% бонус в казино Кэшбэк 10% 100 Фриспинов в подарокVavada официальный сайт

Vavada casino

100% бонус в казино Кэшбэк 10% 100 Фриспинов в подарокVavada официальный сайт Vavada casino

Приветственный бонус за регистрацию Актуальное зеркало Вход на сайт сейчасВход на зеркало Vavada

Vavada casino

Приветственный бонус за регистрацию Актуальное зеркало Вход на сайт сейчасВход на зеркало Vavada Vavada casino

Бонус до 1000$ 100 бесплатных вращений Бонус в Андройд приложенииЗабрать Бонус Вавада

Vavada casino

Бонус до 1000$ 100 бесплатных вращений Бонус в Андройд приложенииЗабрать Бонус Вавада

Почему создание личного кабинета в казино Вавада важно

Создание личного аккаунта в казино Vavada важно по нескольким причинам:

- Доступ к эксклюзивным возможностям: Создав личный аккаунт, вы сможете открыть эксклюзивные возможности и преимущества от казино Вавада, которые недоступны анонимным пользователям. Это может включать в себя персональные акции, бонусы и промокоды, которые могут улучшить ваш игровой опыт.

- Простота пополнения и снятия средств: Имея личный аккаунт, вы можете легко вносить средства на свой счет в казино Вавада и выводить выигрыши. Это избавляет вас от необходимости совершать дополнительные шаги и обеспечивает беспрепятственный и удобный процесс транзакций при блоктровке сайта.

- Повышенная безопасность: Личный счет обеспечивает дополнительный уровень безопасности для ваших средств и личной информации. Создав учетную запись в казино Вавада, вы можете установить надежные пароли, включить дополнительные меры безопасности, такие как двухфакторная аутентификация, и получить больший контроль над своей игровой деятельностью.

- История игр и статистика: С помощью личного аккаунта Vavada вы можете отслеживать историю своих игр, включая данные о ставках, выигрышах и проигрышах. Эта функция позволяет вам анализировать свой игровой процесс и принимать взвешенные решения, чтобы повысить шансы на победу.

- Программы лояльности и VIP-преимущества: Многие онлайн-казино, включая Вавада, предлагают программы лояльности или VIP-схемы для своих зарегистрированных пользователей. Заведя личный аккаунт в казино Вавада, вы получаете право на участие в этих программах, которые часто сопровождаются дополнительными преимуществами, такими как эксклюзивные бонусы, ускоренный вывод средств и индивидуальная поддержка клиентов.

- Участие в жизни сообщества: Имея личный аккаунт, вы можете активно взаимодействовать с другими игроками в сообществе казино Vavada. Это может включать участие в турнирах, посещение чатов или форумов, а также обмен игровым опытом с единомышленниками.

- Инструменты ответственного гемблинга: Вавада вход в личный кабинет, как и многие другие авторитетные онлайн-казино, предоставляет зарегистрированным пользователям инструменты ответственного подхода к азартным играм. Создав учетную запись, вы сможете устанавливать лимиты на депозиты, периоды самоисключения и получать доступ к другим ресурсам ответственного гемблинга, которые способствуют созданию безопасной и контролируемой игровой среды.

- Доступ к широкому спектру игр: Наличие личного аккаунта позволяет вам изучить и насладиться более широким выбором игр live казино, предлагаемых Вавада от разных провайдеров. Некоторые игры могут быть доступны только зарегистрированным пользователям, что дает вам больше возможностей и разнообразия в игровом процессе.

- Персональные рекомендации: Имея личный аккаунт, казино Вавада может использовать ваши игровые предпочтения и активность для предоставления персональных рекомендаций по играм. Эта функция поможет вам открыть для себя новые игры, соответствующие вашим интересам, и повысить общую удовлетворенность игровым процессом dead.

Vavada вход в личный кабинет

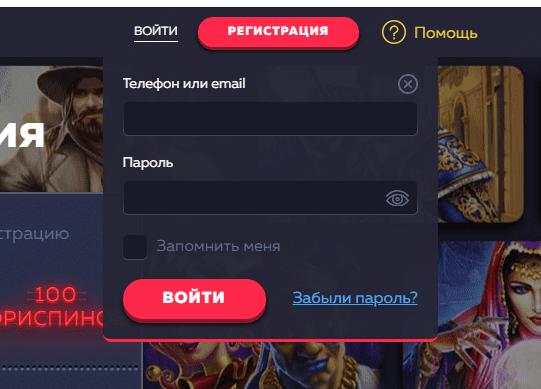

- Посетите сайт Vavada Casino. Откройте предпочтительный веб-браузер и перейдите на официальный сайт Vavada вход с компьютера.

- Нажмите на кнопку «Вход». Найдите кнопку «Вход» или «Регистрация» на главной странице сайта Vavada Casino и нажмите на нее.

- Введите свои учетные данные для входа в систему. На странице входа в систему вам будет предложено ввести имя пользователя или адрес электронной почты и пароль. Заполните эти поля точными данными вашего личного счета и нажмите на кнопку «Войти», чтобы получить доступ к вашему личному счету и выполнить вавада вход с компьютера.

Устранение распространенных проблем с входом в казино Vavada

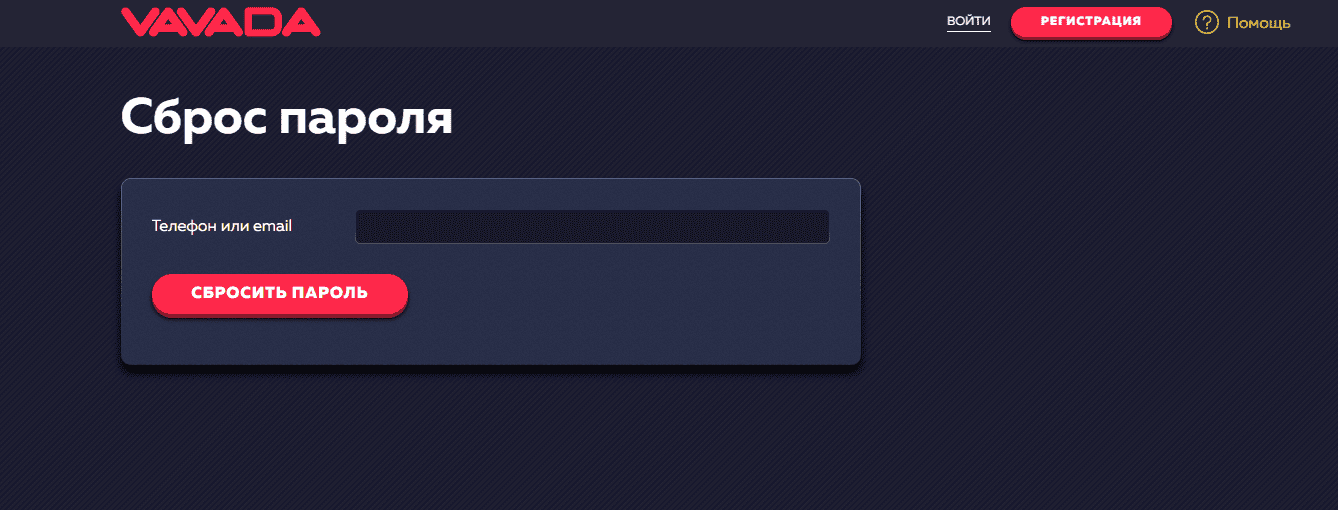

| Забытый пароль | Если новичок забыл свой пароль, он может нажать на опцию «Забыли пароль» на странице входа. После этого пользователю будет предложено ввести зарегистрированный адрес электронной почты. На этот адрес будет отправлено письмо с инструкциями по восстановлению пароля. Следуя инструкциям, полученным по электронной почте, пользователь сможет сбросить пароль и восстановить доступ к своему аккаунту в казино Вавада. |

| Блокировка аккаунта | Если аккаунт пользователя заблокирован, это обычно связано с несколькими неудачными попытками входа в систему или подозрительной активностью на аккаунте. В таких случаях пользователю следует обратиться за помощью в службу поддержки казино Вавада. Сотрудники службы поддержки помогут разблокировать аккаунт и подскажут дополнительные шаги, которые могут потребоваться для защиты аккаунта. |

| Приостановка или прекращение действия учетной записи | Если аккаунт пользователя приостанавливается или прекращается, это, как правило, связано с нарушением правил и условий казино Vavada или с нарушением политики ответственного подхода к азартным играм dead. В таких случаях пользователю следует связаться со службой поддержки Vavada casino для получения дополнительной информации. Сотрудники службы поддержки смогут предоставить подробную информацию о приостановке или прекращении действия лицензии, а также о возможных шагах, которые можно предпринять для решения проблемы. |

Vavada casino

100% бонус в казино Кэшбэк 10% 100 Фриспинов в подарокVavada официальный сайт

Vavada casino

100% бонус в казино Кэшбэк 10% 100 Фриспинов в подарокVavada официальный сайт Vavada casino

Приветственный бонус за регистрацию Актуальное зеркало Вход на сайт сейчасВход на зеркало Vavada

Vavada casino

Приветственный бонус за регистрацию Актуальное зеркало Вход на сайт сейчасВход на зеркало Vavada Vavada casino

Бонус до 1000$ 100 бесплатных вращений Бонус в Андройд приложенииЗабрать Бонус Вавада

Vavada casino

Бонус до 1000$ 100 бесплатных вращений Бонус в Андройд приложенииЗабрать Бонус Вавада

Преимущества и особенности личного кабинета казино Vavada

Личный кабинет в казино Вавада предлагает удобство интерфейса при блокировке, индивидуальный подход dead и глубокие знания для улучшения игрового опыта провайдера.

- Доступ к личной информации и настройкам: Личный кабинет в казино Вавада позволяет пользователям получать доступ и обновлять свою личную информацию, такую как имя, контактные данные и платежные предпочтения. Пользователи также могут управлять настройками своего аккаунта, в том числе изменять пароль и получать уведомления.

- Возможности пополнения и снятия средств: Личный кабинет предоставляет пользователям ряд возможностей для пополнения и снятия средств. Пользователи могут безопасно пополнять свой счет и снимать выигрыши с помощью таких методов, как кредитные/дебетовые карты, электронные кошельки и банковские переводы live.

- Бонусные предложения и акции: Личный кабинет Vavada casino предоставляет пользователям эксклюзивный доступ к бонусным предложениям и промокодам, турнирам и играм. Пользователи могут просматривать и требовать различные бонусы, такие как приветственные бонусы, бесплатные вращения, кешбэк и вознаграждения за лояльность. В личном кабинете также отображаются все активные бонусы и отслеживается прогресс в выполнении требований по отыгрышу.

- История игр и статистика: В личном кабинете пользователи могут просматривать историю и статистику своих игр. Пользователи могут отслеживать свои игровые сессии, включая сыгранные партии, сделанные ставки и выигрыши/проигрыши провайдер. Эта функция дает пользователям представление об их игровой деятельности и помогает им принимать обоснованные решения в будущем.

Меры безопасности для защиты личного аккаунта в казино Vavada

- Надежные и уникальные пароли: Создание надежного и уникального пароля имеет решающее значение для защиты вашего личного счета в Vavada Casino. Избегайте использования общих паролей и используйте комбинацию заглавных и строчных букв, цифр и специальных символов. Так хакерам будет сложнее получить несанкционированный доступ к вашему аккаунту.

- Двухфакторная аутентификация: Двухфакторная аутентификация обеспечивает дополнительный уровень безопасности вашей учетной записи. Эта функция требует, чтобы помимо пароля вы предоставили еще одну форму проверки, например код, отправленный на ваше мобильное устройство. Даже если кому-то удастся узнать ваш пароль, ему все равно понадобится второй фактор, чтобы получить доступ к вашей учетной записи.

- Регулярный мониторинг активности аккаунта: Важно регулярно следить за активностью на вашем счете, чтобы обнаружить подозрительный или несанкционированный доступ. Проверяйте любые незнакомые операции, изменения в настройках учетной записи или неожиданные входы в систему. Если вы заметили необычную активность, немедленно свяжитесь со службой поддержки Vavada Casino, чтобы сообщить о ней и принять необходимые меры для защиты вашего аккаунта.